Featured

4th Eu Money Laundering Directive Ireland

The concept of cash laundering is essential to be understood for those working within the financial sector. It's a course of by which dirty cash is transformed into clear cash. The sources of the cash in actual are prison and the cash is invested in a approach that makes it look like clean money and hide the identity of the legal a part of the money earned.

While executing the financial transactions and establishing relationship with the brand new customers or maintaining present customers the obligation of adopting satisfactory measures lie on each one who is part of the organization. The identification of such aspect to start with is simple to take care of instead realizing and encountering such situations afterward in the transaction stage. The central bank in any nation offers complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to discourage such situations.

Ireland is also obliged to implement certain recommendations of the Financial Action Task Force FATF the international anti-money laundering and anti-terrorist. Monday 29 Apr 2013.

The Fourth Aml Directive And The Eu S Approach To Data Protection A Precautionary Warning Acams Today

The Criminal Justice Money Laundering and Terrorist Financing Acts 2010 to 2021 updated Irish anti-money laundering and terrorist financing legislation and brought it in line with the requirements of EU legislation to prevent money laundering.

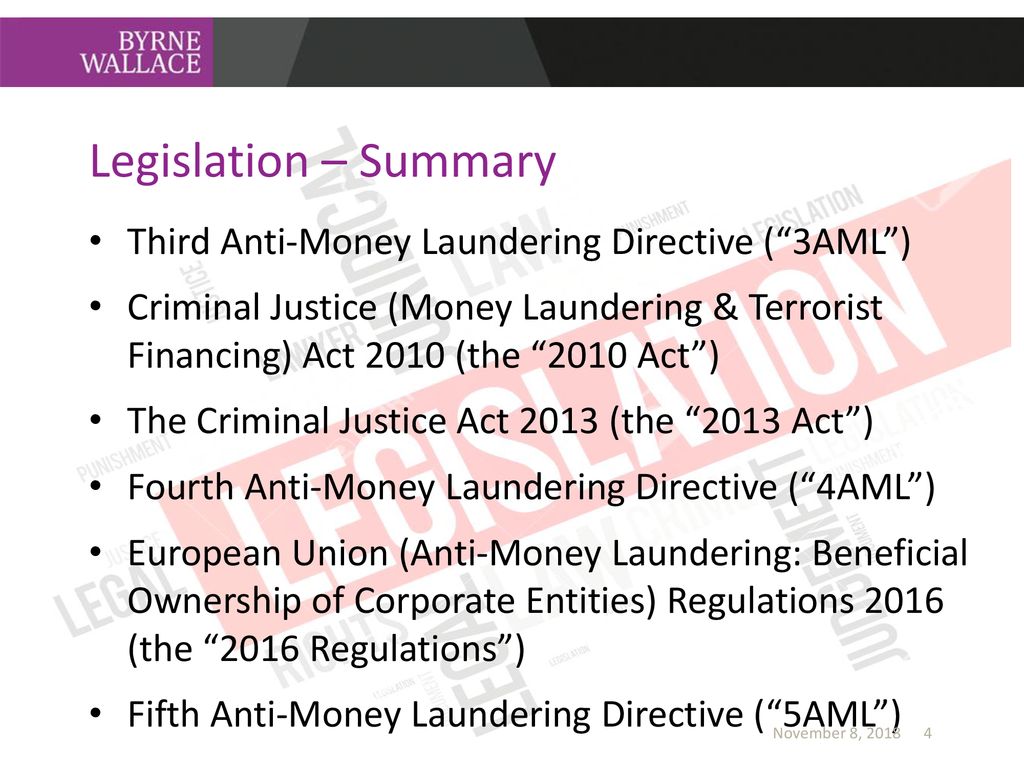

4th eu money laundering directive ireland. The Member States had to transpose this Directive by 10 January 2020. The Fourth EU Anti-Money Laundering Directive AMLD4 was transposed into Irish law 26 June 2017. It carried out a number of modifications to the Third EU AML Directive.

Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector. Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership register. This will bring Ireland in line with the.

Transposition of the Fifth EU Money Laundering Directive in Ireland. Fourth EU AML Directive Transposed Into Irish Law The Criminal Justice Money Laundering and Terrorist Financing Amendment Act 2018 the Act which transposes most of the Fourth EU Money Laundering Directive 2015849 MLD4 into Irish law was enacted on 14 th November 2018 and all but one provision was commenced with effect from 26 th November 2018. It will also ensure consistency in the application of such laws across all EU Member States.

EU 4th Money Laundering Directive. DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive. MLD4 must be enacted by member states and obliged entities must comply with the Directive.

On 29th January 2016 the Department of Finance and the Department of Justice and Equality the Departments published a consultation paper CP on the Member State discretions available to Ireland in transposing the Fourth Anti-Money Laundering Directive Directive EU 2015849 AMLD4 and the Funds Transfer Regulation Regulation EU 2015847 into Irish law. The Fourth EU Money Laundering Directive 4MLD was finally transposed into Irish law with the enactment on 14 November 2018 of the Criminal Justice. - Aligns EU Anti-Money Laundering AML Countering the Financing of.

Ireland may face EU court over anti-laundering law EUs fourth anti-money-laundering directive should have been transposed by last June Wed Apr 4 2018 0431. The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law. European Union Ireland November 29 2018.

On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering Directive was published in the Official Journal of the European Union. 4th EU Money Laundering Directive. 5 th anti-money laundering Directive.

- Directive 200764EC of the European Parliament and the Council of 13 November 2007 on payment services in the internal market Key features of Fourth EU Anti-Money Laundering Directive At a high level 4AMLD. A major part of this is the creation of a Beneficial Owners Register which we covered in a previous blog. However there are some other new provisions to be aware of which are as follows.

The Bill will transpose the Fifth EU Money Laundering Directive the Directive. This Directive is the fourth directive to address the threat of money laundering. On 8 September 2020 the Irish Government approved the Criminal Justice Money Laundering and Terrorist Financing Amendment Bill 2020 the Bill.

The EUs 4th Directive on Anti-Money Laundering MLD4 succeeds the 3rd Directive of 2005. The Department of Justice and Equality will transpose the majority of the Directive by a Criminal Justice Amendment Act the General Scheme of which was agreed by the Cabinet on 3 January 2019. AML4 was transposed into Irish law in November 2018 through an amendment to the previous Criminal Justice Money Laundering and Terrorist Financing Act 2010.

One of these proposals was a directive on the prevention and use of the financial system for the purpose of money laundering and terrorist financing. A package of amendments to the 4th Anti- Money Laundering Directive known as 5AMLD was adopted on 30 May 2018 as Directive 2018843. On 5 February 2013 the European Commission adopted two new proposals in the fight against money laundering tax evasion and terrorist financing.

It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws. The Fourth Anti Money Laundering Directive 4AMLD implemented the new recommendation by Financial Action Task Force 2012 FATF and revised the terms of the treaty once more to remove any ambiguities and improve consistency of AML and CTF. The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015.

Fourth Eu Aml Directive Transposed Into Irish Law Kb Associates

Anti Money Laundering A 2019 Perspective From European Union Biia Com Business Information Industry Association

Annual Criminal Justice Antimoney Laundering Terrorist Financing Act

Brokers Ireland Anti Money Laundering Presentation Ppt Download

Commission Overhauls Anti Money Laundering And Countering The Financing Of Terrorism Rules

Anti Money Laundering What It Is And Why It Matters Sas

4th European Anti Money Laundering Directive Comes Into Force Lawware

Notifications Anti Money Laundering Compliance Unit

4th Aml Directive What Are The Additional Changes

European Union Money Laundering Directives Overview Cams Afroza

Eu 5th Eu Anti Money Laundering Directive Published

Stubbs Gazette Handbook Final Version

Financial Crime How The Eu Commission Overhauls Rules On Anti Money Laundering And Terrorist Financing Ieu Monitoring

The 5amld What Changes To Expect Government Public Sector European Union

The world of laws can look like a bowl of alphabet soup at times. US money laundering laws are no exception. Now we have compiled a listing of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting agency focused on defending financial companies by reducing danger, fraud and losses. We now have huge financial institution expertise in operational and regulatory danger. We've got a strong background in program administration, regulatory and operational risk in addition to Lean Six Sigma and Enterprise Process Outsourcing.

Thus cash laundering brings many antagonistic penalties to the organization as a result of dangers it presents. It will increase the likelihood of main risks and the opportunity price of the financial institution and ultimately causes the financial institution to face losses.

Popular Posts

How To Get Boat Dealers License In Texas

- Get link

- Other Apps

Comments

Post a Comment